PM Shram Yogi Maan-dhan Pension Scheme: What Happens If Beneficiary Dies? Check Eligibility, Payout, Withdrawal Criteria And How To Apply

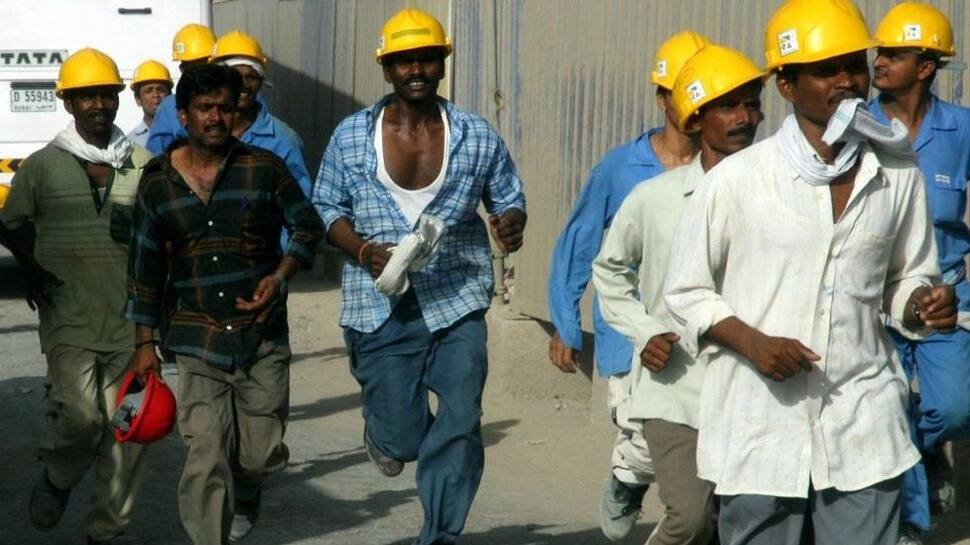

Pension Scheme For Unorganised Workers: The PM Shram Yogi Maan-dhan (PM-SYM) is a pension scheme designed to provide old-age protection for unorganised workers, especially senior citizens. On 21st October 2024, the Ministry launched e-Shram as a one-stop solution for unorganised workers, integrating 12 Central government schemes such as PM Suraksha Bima Yojana, Ayushman Bharat, and MGNREGA.

The platform enables workers to access social security benefits and track the ones they have availed. As of 28th January, more than 30.58 crore unorganised workers have registered on the portal. In 2024, it recorded 1.23 crore new registrations, with an average of 33,700 enrollments daily. Many unorganised workers are excluded from formal social security schemes like EPS, leaving them vulnerable to financial risks.

E-Shram Portal – A One-Stop Solution

)

It is an age-old pension scheme, launched on 26th August 2021, the E-Shram portal creates a National Database of Unorganised Workers (NDUW), linking Aadhaar to provide a Universal Account Number (UAN).

PM-SYM: Pension Scheme for Unorganised Workers

The PM-SYM scheme offers social security to workers in occupations like street vendors, domestic workers, rickshaw pullers, and more, ensuring protection in old age.

PM-SYM: Guaranteed Pension Payout

Beneficiary receive a minimum pension of Rs 3,000/month after age of 60. Upon the beneficiary's death, the spouse gets 50% of the pension as family pension.

PM-SYM: Eligibility Criteria

The scheme is available to workers aged 18-40 with a monthly income of Rs 15,000 or less and excludes those in the organised sector.

PM-SYM: How To Enroll In PM-SYM Scheme?

Step 1: The unorganised worker should visit the nearest Common Services Centre (CSC) for enrollment in the PM-SYM scheme.

Step 2: Carry your Aadhaar Card and Savings Bank/Jan-Dhan account number for enrollment on a self-certification basis.

Step 3: The first subscription must be paid in cash, while future payments will be auto-debited from the linked bank account.

Step 4: Workers who are income tax payers or have a membership in EPF, NPS, or ESIC are not eligible for the scheme.

PM-SYM Scheme: Exit and Withdrawal Criteria

Early Exit (Before 10 Years): If you exit before 10 years, only your contribution will be refunded with savings bank interest rate.

Death of Beneficiary: If the beneficiary dies, the spouse can continue the scheme or exit and receive contributions with accumulated interest.

Death of Both Beneficiary & Spouse: After both pass away, the entire corpus will be returned to the scheme’s fund.

Permanent Disability Before 60: If permanently disabled, the spouse can continue or exit and receive contributions with interest, whichever amount is higher.

Beneficiary Dies: If the beneficiary dies, the spouse can continue the scheme by making regular contributions or exit and receive contributions with interest.

Subscriber Missed Contributions?

If a subscriber misses contributions, they can resume the scheme by paying all outstanding dues along with any penalty set by the Government. (Image Credit: Wikipedia)

Trending Photos